iText 7 Core and pdfHTML - enabling online insurance services and document archiving

How one of Germany’s leading life insurance companies uses iText to allow online insurance services with digital signature capabilities and long-term archival of email communications.

Background

WWK Lebensversicherung a. G. is a Munich-based insurance group. Founded in 1884 as a widow and orphan support fund for the Bavarian Traffic Officials Association (WWUK), they have become one of Germany’s leading insurance companies, offering a wide range of products and policies including pensions, life insurance, and accident insurance.

Like many insurance companies across the world, they have a need to create, edit, and manipulate PDF documents – whether they be customer documents such as policy contracts or pension statements, or documents for internal usage such as reports. WWK has been a long-time user of iText for such tasks, with legacy processes implemented using iText 2. However, recent years have seen changes in the nature of their business; providing more and more online and digital processes for their customers and agents, such as online portals for policy applications, or data requests, and enabling features such as digital signatures.

Over the last couple of years, WWK decided to look at their options to overhaul their processes, both internal and external. This has proven to have been well-timed, as the recent pandemic has only accelerated the demand for digital-only customer experiences.

Goals

- update their legacy processes for reading, creating, merging PDFs, and splitting large documents into smaller ones

- dynamically process data from customer and client portals, and serving application forms for online applications

- transform emails and images into PDF for archiving purposes

Challenges

Key challenges were to replace the legacy iText 2 processes with iText 7 and take advantage of its newer capabilities. In addition, they wanted to modernize and improve their archiving processes based on saving documents in TIFF format, and thus making the sharing and extraction of data less difficult.

Solution

WWK has a team of around 30 developers, about half a dozen of which have iText-related responsibilities. For this team, replacing the legacy processes for creating and manipulating PDFs meant some reimplementation of code, due to significant changes to iText 7’s API compared to previous versions. However, they found the API changes meant it was both easier to read and more functional, with clear benefits over previous versions, such as the updated digital signing capabilities with support for modern signing standards and cryptographic algorithms, and iText 7’s improved exception handling.

|

Our developers tell me the iText 7 API is easier to read and more functional, and that the improved exception handling is definitely a benefit. |

|

Jörn Kolberg, Software Engineer at WWK |

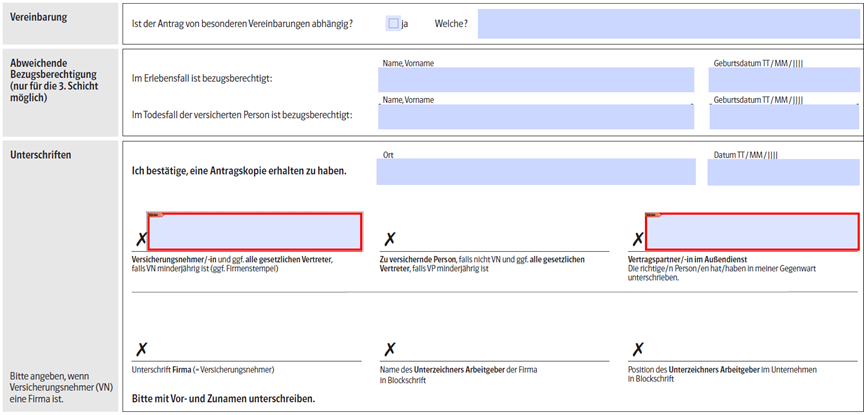

Of course, a key component in WWK’s iText usage is the reading, creating, merging PDFs, and splitting of large documents. However, in addition to these core PDF functionalities, a large part of their iText usage is to handle and process input from web portals. “We’re actually using iText for several portal applications” says Jörn Kolberg, Software Engineer at WWK. “We have a customer portal, an agent portal, and an application for online insurance applications.” Input from this application is used to complete the required fields in the application form. As Jörn explains, “If you apply for insurance, you have a form that you have to fill out, and that is done with iText. So, the application maps the input from the web form to the PDF form, either with or without secure electronic signatures.”

WWK makes use of the InSign digital signing service to enable the quick and easy signing of documents in a completely digital and legally compliant way. These signatures are eIDAS-compliant and certified by the Federal Inspection Association (TÜV) and the ability to sign and authenticate policy documentation online has been particularly important during the coronavirus pandemic. By using iText, they can create documents with digital signatures fields and then sign the PDF with the digital signatures provided by InSign.

|

There is a lot of good documentation and examples for iText on the Internet, which was very helpful to us. |

|

Jörn Kolberg, Software Engineer at WWK |

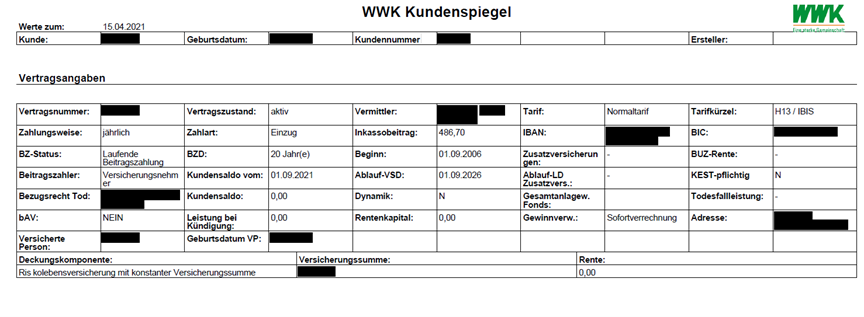

In addition to filling out application forms, WWK uses iText to generate insurance policy statements and reports so that customers can see how their portfolio is performing.

iText is not just used for customer-facing applications though. WWK also allows their agents to log into their agent portal to generate PDF reports so they can see how much they have earned.

In addition, they utilize the pdfHTML iText 7 add-on to transform email communications into PDF for archival purposes – something that was not part of their existing processes. As Jörn explains, in many cases WWK needs to share data contained in emails with their agents and customers. To achieve this using the previous process would require creating PDFs from existing TIFF and multi-page TIFF files, leading to increased memory usage and storage requirements. Using pdfHTML to create PDFs directly from the emails themselves is a much better solution, since data can be easily extracted from such documents or shared as required. These PDFs can then be stored in their document archive as PDF/A, the standard for long-term archiving.

As Jörn says, “We used to archive documents as TIFF. So, if you wanted to give a document to the agent or to the customer, you would have to convert it or make a PDF from a TIFF or multi-page TIFF. That is sometimes a little bit of a pain, so of course it is much easier if you just archive a PDF document, and then you can pull it straight out as required.”

Result

WWK is very happy with the results of their iText 7 migration, and the increased capabilities offered by the iText 7 Core library and its add-ons. In addition to pdfHTML, they are also looking into how they might benefit from the features offered by the rest of the iText 7 Suite, such as secure redaction, PDF optimization, optical character recognition, and much more.

About

The WWK was founded in Munich in 1884 as a widow and orphan support fund of the Bavarian Traffic Officials Association (WWUK), and for over 135 years they have had the financial security of their customers and families in mind.

With over 1.3 million satisfied customers, around 1,300 employees, more than 1,200 sales partners and approximately 6,000 brokers and multiple agents, WWK is one of the market leaders in unit-linked life insurance thanks to its innovation and performance. By picking up on trends at an early stage, they can develop innovative products that are always optimally tailored to the needs of customers.

Since WWK is a mutual insurance association, they are exclusively committed to their customers and act independently of shareholders' interests. Their continuing and enduring success is due to this independence from outside influence, ensuing stability, reliability, and sustainability.

In terms of financial solidity and net equity, the life insurance group has long been one of the strongest in Germany, befitting its business volume. FOCUS-MONEY magazine periodically analyzes the long-term solidity of all Germany life insurers. The result: In 2021, WWK Lebensversicherung a. G. received the highest solidity ranking among all insurers – for an impressive 16th time in a row.

Their strong sales success in both Germany and Austria is attributed to the quality of their products, and well-established, agile support teams. For this achievement, they were awarded the honor of "German Champion" among life insurers by the analysis company ServiceValue, in cooperation with the daily newspaper Die Welt.